Presidential frontrunner Ferdinand Marcos falsely claimed that his father’s “Masagana 99” was a success and wants to bring it back despite several studies showing how it bankrupted rural banks and forced thousands of farmers into debt.

Marcos made this claim during the presidential debate hosted by Sonshine Media Network International (SMNI) – the media arm of Presidential Spiritual Adviser Apollo Quiboloy’s Kingdom of Jesus Christ – on February 15. He cited Masagana 99 as a solution to boost rice production and claimed that it would be a good model for attaining rice self-sufficiency and food security.

However, several agricultural economists have said that while initially successful, the Marcos-era program was a mess that failed to live up to its potential and ended up hurting more than helping farmers.

Golden Seeds

When the Philippines faced a rice shortage in 1972 after natural disasters, pest problems, and ravaged crops, the government had a promising answer called Masagana 99. The program had three main goals: to recover previous losses, scale down importation, and achieve rice self-sufficiency.

Instead of increasing the amount of land farmed, Masagana 99 aimed to increase the rice yield per hectare to 99 cavans, more than doubling the then national average of 40 cavans per hectare. The Department of Agriculture (DA) planned to do this by implementing a two-pronged approach: developing more effective farming technology, and then offering loan programs that gave farmers access to this technology.

Researchers from the International Rice Research Institute in Los Baños, Laguna spearheaded the development of an “integrated package of technology” which could produce the 99 cavan-yield per hectare even in non-irrigated land, which then DA secretary Arturo Tangco Jr. would later approve.

Meanwhile, the Central Bank channeled funds to lower the cost of borrowing and get the technology into the hands of most farmers. It was partially funded by the United States Agency for International Development (USAID) and the World Bank.

This combination was initially effective, as the World Bank praised the program in 1982 for letting farmers access billions of pesos in credit and for letting the country reach rice self-sufficiency by 1997.

As Philippine Rice Research Institute executive director Dr. Santiago Obien noted, the program was successful in “producing enough food at that time, and in averting some potential social problems.” However, Obien said that the program had its share of problems

Rotten Fruit

Only a year after the World Bank praised the program for its success in distributing credit, they said that many farmers failed to pay because of accumulated overdue fees caused by problems in the program’s management among others.

Credit interests soared from 12% to 16-38%, further incapacitating the farmers’ ability to pay off their debts. The overdue fees “disqualified a large number of small farmers from receiving fresh credit and also disqualified many rural banks from receiving rediscounting support from the Central Bank.”

Apart from staggering debt to the World Bank, the agriculture sector’s productivity almost reached a flatline, with more chemical imports than growth in local production.

This lack of repayment meant that the program’s funds were running out. As a 1991 report found, about 80% of the Masagana-99 loans were never paid. Although Cornell University professor Randolph Barker spun it positively by calling it a “money transfer” instead, this meant that the program would inevitably crash and burn.

Because of its unsustainability, Kenneth Smith lamented its wasted potential, saying that “the program’s actual achievements were much more mundane than anticipated, and even this degree of success was more fortuitous than finessed.

As Finance Secretary Carlos Dominguez III pointed out, however, the worst thing is not that the program wasted its potential; it is that Masagana 99 tanked the rural banking system and pushed thousands of farmers into debt as well.

After Senator Imee Marcos said that Masagana 99 was an effective use of banks for agriculture in the 70s, Dominguez decided to counter the senator’s claims. “I was the Secretary of Agriculture who cleaned up the mess that was left by Masagana 99. There were about 800 rural banks that were bankrupted by that program and we had to rescue them,” he said.

The dictator’s daughter replied that while it may have had its problems on the banking end, it made up for it in terms of rice exportation. When looking at the data, however, Eduardo Tadem found that this was only true for a few years, as the country stopped exporting once more in 1985.

Tadem also found that the program only worsened lives for the farmers, as all of their production gains were canceled out by increased costs. In the end, they were in debt with no improvements to show for it.

Despite its initial success, the program failed. As National Scientist Emil Javier wrote in a column for the Manila Bulletin: “Masagana 99 proved to be short-lived and unsustainable mainly due to the costly subsidies and failure of many farmers-borrowers to repay the loans . . . By [1980], Masagana 99 ceased to be of consequence as only 3.7% of the small rice farmers were able to borrow.”

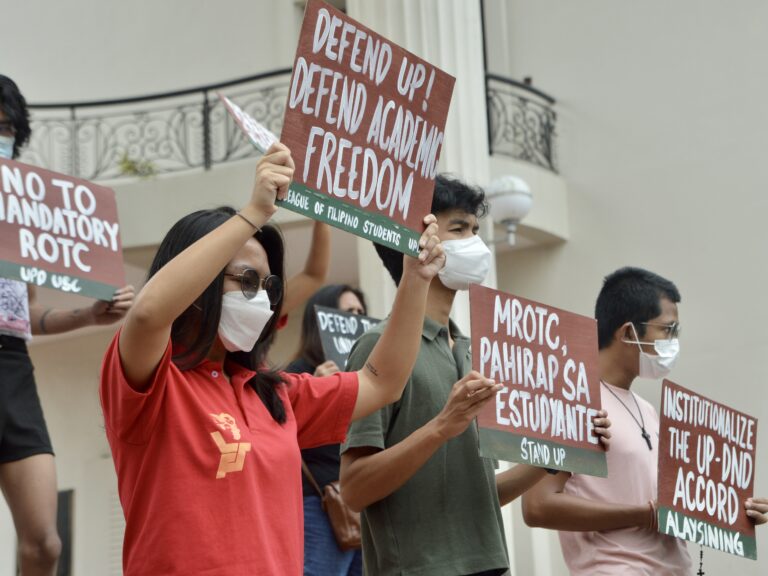

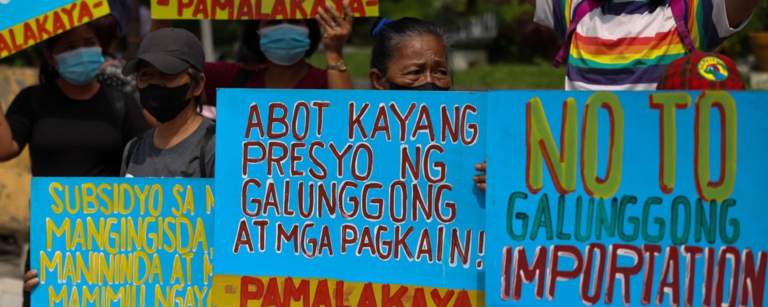

Scientists, economists, and farmers continue to condemn Masagana 99’s failure and Marcos’s attempt at distorting history. Farmers’ group MASIPAG condemned how “the Philippine rice industry was reoriented into a profit-based, corporatized business venture through Marcos’ agricultural project, Masagana 99.

“The attempt at ‘modernized’ rice production failed, and it was at the expense of our Filipino farmers and the country’s food security.”�

F*ckin?remarkable things here. I抦 very glad to see your post. Thanks a lot and i am looking forward to contact you. Will you kindly drop me a e-mail?